This company is an extremely fast-mover.

With an impressive growth surge over the past year…backing by some of the smartest money on the planet…and the growth potential for the global cannabis market…this company could quickly become the #1 investment story of 2019.

PLUS Products Inc. (CSE: PLUS); (OTC: PLPRF) is already one of the largest – and fastest-growing – players in the U.S. edible cannabis market.

PLUS Products is a branded products manufacturer based in California. Its products consist of cannabis-infused edibles, which it sells to both the regulated medicinal and adult-use recreational markets.

The Company’s mission is to make cannabis safe and approachable — that starts with manufacturing high-quality products delivering consistent experiences.

And with major expansion plans on the horizon…PLUS Products’ incredible story has only just begun to be written.

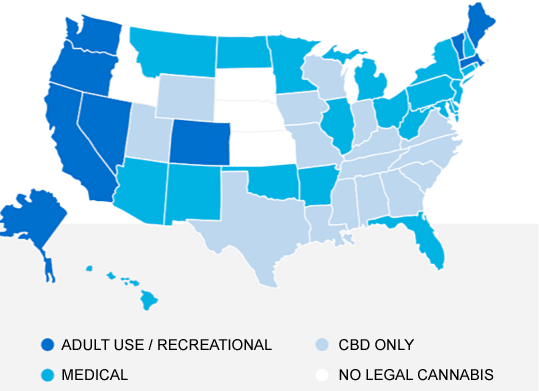

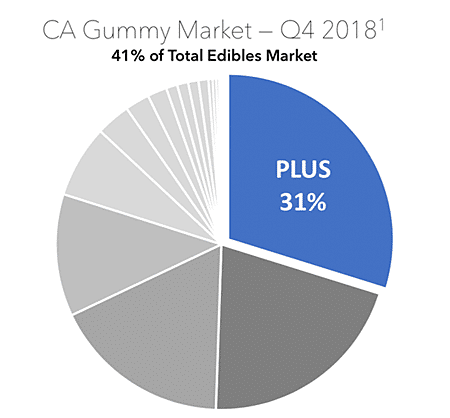

PLUS Products is Dominating the Market as the #1 Edibles Brand in California

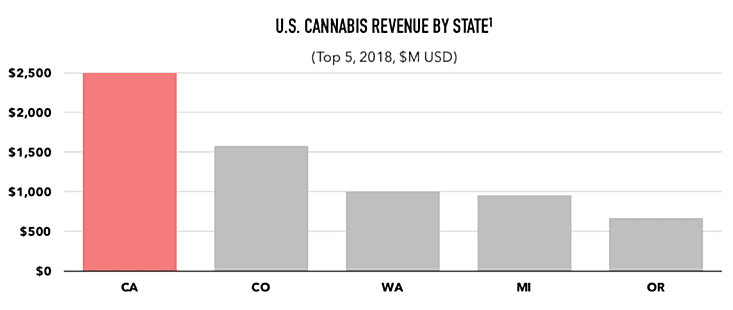

California is a huge market that generates more than $2.5 billion per year in cannabis sales – by far the largest market in the United States.

And due to California’s long history of medical legalization – dating back to 1996 – there is tremendous competition for edibles brands in the state.

It is in that large, hyper-competitive market that PLUS Products Inc. has quickly begun to dominate the competition.

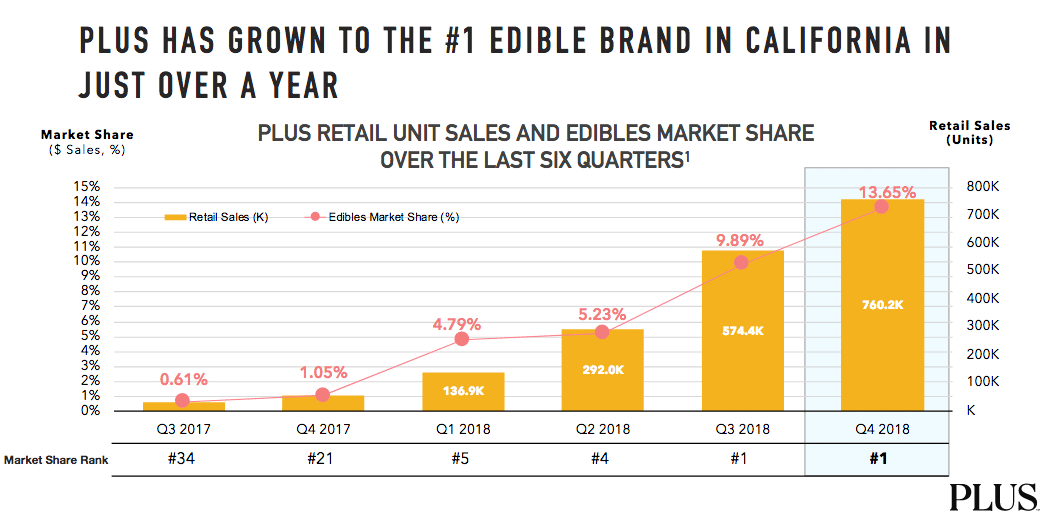

Here’s how fast PLUS Products has grown in the Golden State:

In the 2nd quarter of 2017, PLUS Products was ranked #43 in the California edibles market – with less than one-half of one percent market share.

Fast forward to the 4th quarter of 2018…and PLUS Products had become the #1 ranked edibles brand in California – increasing its market share by 36 times with 13.65 percent of this massive market.

In fact, according to BDS Analytics, PLUS Products not only maintained its position as the #1 best-selling cannabis-infused edibles brand in California in Q4, but saw its lead over the #2 brand widen over the prior quarter.

The company also had 3 of the 5 best-selling branded products in all product categories including flower, vaporizers, edibles and topicals.

PLUS “Uplift” and PLUS “Restore” remained the #1 and #2 best-selling SKUs. PLUS “CBD Relief” was the #5 best-selling SKU, and the top CBD-only SKU according to BDS analytics.

PLUS Products Inc. (CSE: PLUS); (OTC: PLPRF) is now embarking on plans to cement its position in California through new product launches and acquisitions…as well as expanding into more states (more on this in a moment.)

PLUS Products’ Rapid Growth – and Significant Backer – are Turning Heads in the Market

With such rapid growth – in the world’s largest and most competitive market – it’s no surprise that the PLUS Products story is gaining attention.

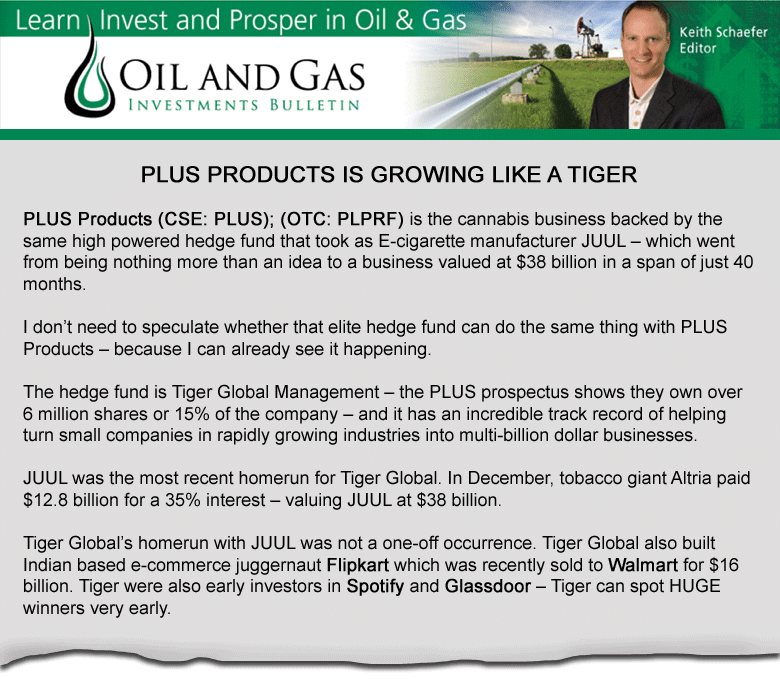

Just recently, veteran newsletter writer Keith Schaefer featured the company in a message to his Oil & Gas Investments Bulletin subscribers.

Of course…when a newsletter writer who typically focuses on oil & gas investments – as Keith Schaefer does – takes notice of a company outside that space…it’s typically for good reason.

And in this case, Keith was drawn to the company because some of the smartest money on the planet – famous hedge fund Tiger Global Management – has invested in PLUS Products (CSE: PLUS); (OTC: PLPRF).

Here’s an excerpt of what Keith told his subscribers about PLUS Products (CSE: PLUS); (OTC: PLPRF):

The U.S. Cannabis Market is Still in its Early Stages of Growth

The U.S. cannabis market is expected to soar to annual sales of $80 billion by 2030, according to investment bank Cowen Inc.iii

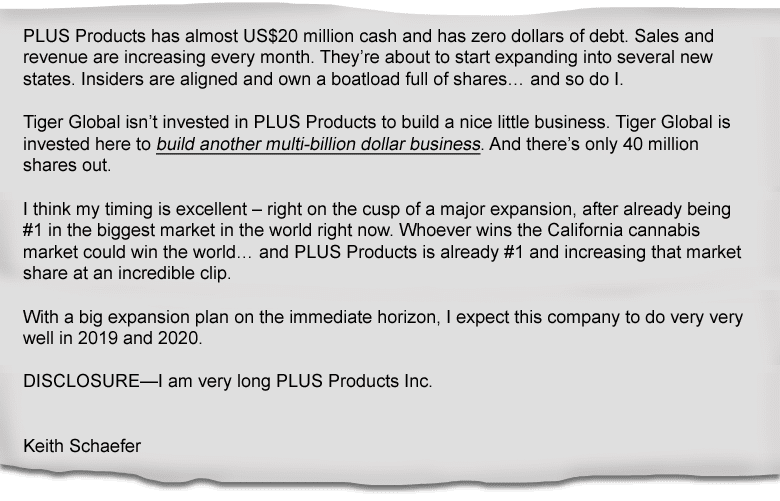

With medical marijuana use legalized in 33 U.S. states – and recreational use approved in ten states – the overwhelming trend is toward legalization throughout the U.S…and a rapidly-growing market.

As discussed above, PLUS Products Inc. already has winning products in the California Adult-Use market, including the best-selling CBD edible.

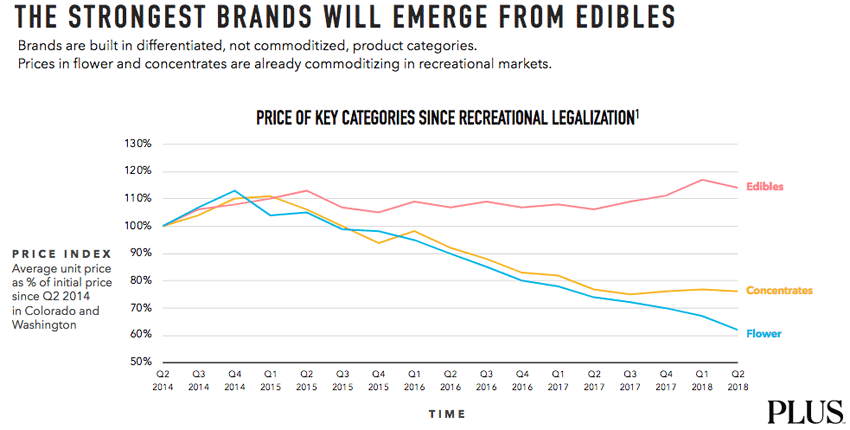

Many companies in the cannabis space are relying on flower and oil sales to drive their top-line revenues, however these markets have already begun to commoditize. 100% of PLUS Products’ revenue has been derived from edibles — the segment of the market from which the strongest brands will emerge.

And as the United States moves closer to legalization at the federal level…PLUS Products Inc. stands poised to take advantage of the expected growth in the U.S. market by bringing its proven brands to new markets in all segments.

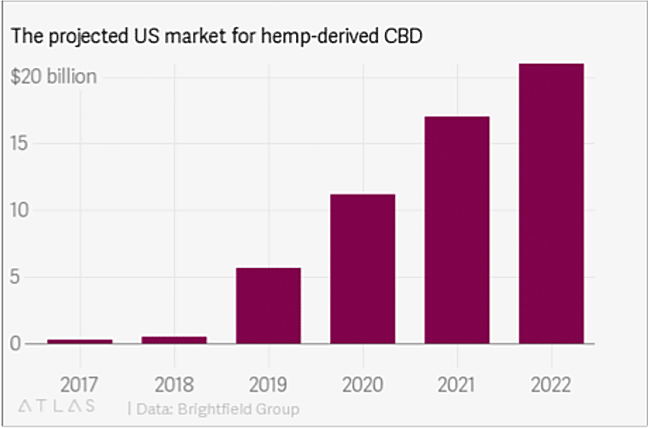

As the regulatory situation around hemp CBD clarifies, PLUS Products intends to bring its winning formula to this rapidly growing market. Which some estimate will be as large as $20 billion in just a few years.

PLUS Products Inc. (CSE: PLUS); (OTC: PLPRF) Has Quickly Become the #1 Edibles Brand in the Largest – and Most Competitive Market

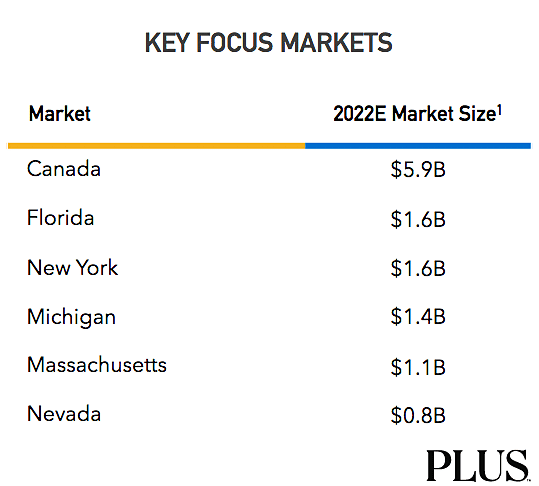

Building on the company’s tremendous success in California, PLUS Products Inc. has plans to expand into new jurisdictions quickly both through direct ownership and partnerships.

PLUS Products Inc. is in the midst of successfully executing a simple growth plan with the ultimate goal of becoming the world’s strongest cannabis brand.

This plan consists of the following steps:

- Win in the largest market – California is the largest and most competitive cannabis market in the world…and PLUS Products is already the #1 edibles brand in California.

- Expand to additional legal markets – PLUS Products intends to expand into other legal adult-use markets in the U.S. and internationally through new product launches and acquisitions.

- Foundation established to execute – PLUS Products Inc. is led by a world class leadership team…an outstanding operational team that has rapidly scaled manufacturing…and PLUS has established a strong cash position raising over US$30 million in 2018 alone.

Of course, history has shown that companies who establish a dominant position as the #1 brand in a particular space can quickly become a target for acquisition by larger companies looking to expand rapidly.

That type of scenario – where PLUS Products becomes a potential acquisition – is certainly something investors should consider, as this could help drive a rapid rise in valuation for the company.

A World Class Leadership Team and Efficient Share Structure Help Make PLUS Products Inc. a High-Upside Opportunity

PLUS Products Inc. (CSE: PLUS); (OTC: PLPRF) is led by a world-class management team that includes several decades of experience in the areas of finance, branding, marketing, risk management and strategic planning.

Jake Heimark – Chief Executive Officer

Jake Heimark is an expert in Strategy & Branding. This tech entrepreneur has previously worked at both Facebook and at Gumroad as a Product Manager.

Jennifer Tung – Chief Risk Officer

An expert in both Risk Management and Strategy, Jennifer Tung brings to Plus Products a wealth of experience from her time as Legal Director for Uber and Lead Payments Counsel at Facebook.

Craig Heimark – Chairman, Chief Financial Officer

Formerly Chief Information Officer at UBS and Supervisory Board Member of Deutsche-Borse AG, Craig Heimark brings expertise in both Finance & Strategy to the Plus Products team.

Jon Paul – Senior Financial Advisor

Jon Paul brings more than 25 years of experience in CFO roles – including time as CFO of Fair Oaks Farms – to Plus Products Inc.

In addition, the company has assembled an outstanding operational and product team that will help the company scale operations quickly as needed. This dynamic team includes:

- Former EVP Operations @ Lagunitas Brewing

- Operations Manager @ GRUMA

- Former chocolatier @ Tcho Chocolate

- Former Michelin Star Chef

- Former Pepsi Food Scientist

- Harvard Chemist.

Over the course of 2018, this outstanding team was able to scale production capabilities by 500% while maintaining PLUS Products’ industry-leading product consistency and dosing.

Another important consideration for PLUS Products Inc. (CSE: PLUS); (OTC: PLPRF) is the company’s efficient share structure and balance sheet.

With the company having raised over US$30 million in cash in 2018 – and with a tight share structure of just over 45 million fully diluted – PLUS Products Inc. is well-positioned to deliver high upside potential for investors should it continue its extraordinary growth.

1) PLUS is the #1 Edibles Brand in the Biggest, Most Competitive Market – PLUS Products is the #1 ranked edibles brand in California – increasing its market share by 36 times with 13.65 percent of the California market.

1) PLUS is the #1 Edibles Brand in the Biggest, Most Competitive Market – PLUS Products is the #1 ranked edibles brand in California – increasing its market share by 36 times with 13.65 percent of the California market.

2) Backed by Tiger Global – World-famous hedge fund Tiger Global Management owns 15% of PLUS Products Inc. (CSE: PLUS); (OTC: PLPRF). Tiger Global has a history of turning small companies in rapidly growing industries into multi-billion dollar businesses – as they did with JUUL, helping take that E-Cigarette manufacturer from just an idea to a $38 billion business in just 40 months.

3) Expansion Plans — PLUS Products (CSE: PLUS); (OTC: PLPRF) is working to build the world’s strongest cannabis brand by expanding into new jurisdictions quickly both through direct ownership and partnerships.

4) Rapidly Growing U.S. Cannabis Market – The U.S. cannabis market is expected to soar to annual sales of $80 billion by 2030…and with the majority of U.S. states already having some form of legal cannabis, PLUS Products stands poised to take advantage of the expected growth in the U.S. market by bringing its proven brands to new markets across all segments.

5) High Upside Potential for Investors – PLUS Products (CSE: PLUS); (OTC: PLPRF) has a solid balance sheet…raised over US$30 million in cash in 2018…and a tight share structure of just over 45 million fully diluted.

i Arcview Market Research & BDS Analytics: The State of Legal Marijuana Markets 6th edition Update

ii BDS Analytics GreenEdge™; Retail Sales Q2 2017-Q4 2018: Non-generic Products, Excluding Tinctures

iii https://finance.yahoo.com/news/cannabis-poised-80-billion-industry-222331008.html

Disclaimer: This release/advertorial is a commercial advertisement and is for general information purposes only. This is a Native Advertisement, meaning it is an informational paid marketing piece. MarijuanaStox.com makes no recommendation that the securities of the companies profiled or discussed on this website should be purchased, sold or held by viewers that learn of the profiled companies through our website. Please review all investment decisions with a licensed investment advisor. This Advertorial was paid for by PLUS Products in an effort to enhance public awareness of PLUS Products and its securities. Winning Media has received PLUS Products a fee of over $1,000 as a total production budget for this advertising effort. Neither MarijuanaStox.com or Winning Media currently holds the securities of PLUS Products and does not currently intend to purchase such securities. This Advertorial contains forward-looking statements that involve risks and uncertainties. This Advertorial contains or incorporates by reference forward-looking statements, including certain information with respect to plans and strategies of the featured Company. As such, any statements contained herein or incorporated herein by reference that are not statements of historical fact may be deemed to be forward-looking statements. Without limiting the foregoing, the words “believe(s)” “anticipate(s)”, “plan(s)” “expect(s)” “project(s)” “will” “make” “told” and similar expressions are intended to identify forward-looking statements. There are a number of important factors that could cau se actual events or actual results of the Company to differ materially from these indicated by such forward-looking statements. Certain statements contained herein constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and 21E of the Exchange Act of 1934. Such statements include, without limitation, statements regarding business, financing, business trends, future operating revenues and expenses. There can be no assurance that such expectations will prove to be correct. Investors are cautioned that any forward-looking statements made by the Company, or contained in this advertorial are not guarantees of future performance, and that the Issuer’s actual results may differ materially from those set forth in the forward-looking statements. Difference in results can be caused by various factors including, but not limited to, the Company’s ability to be able to successfully complete planned funding agreements, to successfully market its products in competitive industries or to effectively implement its business plan or strategies. To reiterate, information presented in this advertorial contains “forward-looking statements”. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions, or future events or performance are not statements of historical fact and may be “forward-looking statements.” Forward-looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward-looking statements in this advertorial may be identified through the use of words such as “expects,” “will,” “anticipates,” “estimates,” “believes,” “may,” or by statements indicating certain actions “may,” “could,” or “might” occur. More information on the Company may be found at www.sec.gov readers can review all public filings by the Company at the SEC’s EDGAR page. MarijuanaStox.com is not a certified financial analyst or licensed in the securities industry in any manner. The information in this Advertorial is subjective opinion and may not be complete, accurate or current and was paid for, so this could create a conflict of interest.