Canopy Rivers Inc. (TSX.V: RIV); (OTC: CNPOF) offers investors diversification, access and a premier strategic partner

Get ready – this investment has game-changing potential.

As you already know, explosive growth is projected for 2019 – and beyond – in the red-hot legal cannabis industry.

In the midst of this rapid growth, one unique cannabis investment – Canadian-based Canopy Rivers Inc. (TSX.V: RIV); (OTC: CNPOF) – is now generating attention in the marketplace.

Here’s what is unfolding – and why Canopy Rivers represents such an intriguing opportunity for investors…

High Upside Potential for the Next Phase of Growth in the Cannabis Sector

Experts project that global consumer cannabis spending will skyrocket by 38% in 2019 to $16.9 billion, up from an estimated $12.2 billion in 2018, $9.5 billion in 2017, and $6.9 billion in 2016.

Going forward, the industry is expected to produce compound annual sales growth of 26.7% from 2017 and 2022, with global cannabis sales reaching $31.3 billion by 2022.iii

But as the cannabis industry matures and evolves, the opportunities for investors to profit from the “cannabis boom” will also change.

Early-stage growth opportunities to profit from publicly-traded licensed producers are being replaced by potential high-upside plays in cultivation, extraction, distribution and other segments of the industry.

An investment in Canopy Rivers offers investors the unique opportunity to invest in a diversified collection of companies across the entire cannabis ecosystem.

As the name might suggest – Canopy Rivers Inc. (TSX.V: RIV); (OTC: CNPOF) – also provides the unique advantage of a strategic relationship with Canopy Growth Corporation (NYSE: CGC); (TSX: WEED), the world’s largest and leading medical cannabis company.

Canopy Rivers is generating attention in the marketplace.

In fact, just recently – in January 2019 – veteran newsletter writer Keith Schaefer profiled the company for his Oil & Gas Investments Bulletin subscribers.

Here’s why that’s significant:

Keith Schaefer ordinarily focuses on the oil and gas sector – NOT the cannabis space. He’s built an impressive track record over the last ten years by focusing on the fundamentals of companies.

He’s a numbers-driven guy – and when he sees an investment with a business model that provides a significant advantage…he is quick to seize the opportunity.

In the case of Canopy Rivers, the fundamentals of the business clearly made Keith Schaefer sit up and take notice…so much so that he fired off a detailed profile to his subscribers.

Here’s a portion of what Keith had to say when he profiled Canopy Rivers Inc. (TSX.V: RIV); (OTC: CNPOF):

How the Unique Canopy Rivers (TSX.V: RIV); (OTC: CNPOF) Business Model Works

Canopy Rivers offers individual investors the opportunity to invest in hand-picked opportunities throughout the entire cannabis space.

Here’s how it works:

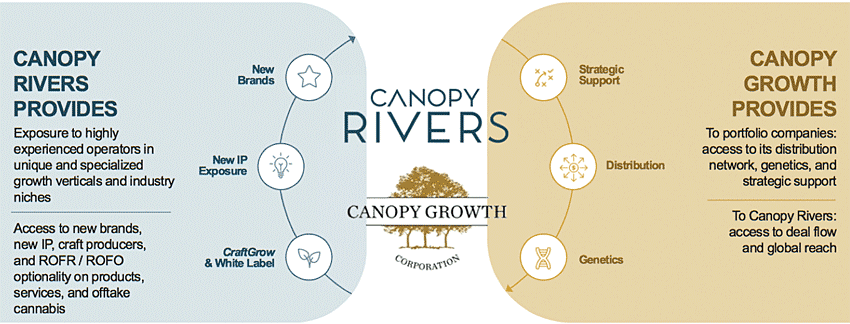

Canopy Rivers (TSX.V: RIV); (OTC: CNPOF) is a strategic investment and operating platform focusing on the emerging global cannabis industry.

Made up of individuals with financial and technical expertise, the team is laser-focused on finding best-in-class companies to invest in.

The company works collaboratively with Canopy Growth to identify up-and-coming companies seeking financial and/or operating support and affiliation with the Canopy Growth group of companies.

These partnerships have created an ecosystem of complementary companies that operate throughout the cannabis value chain.

As Canopy Rivers’ portfolio continues to develop, each constituent benefits from opportunities to collaborate with Canopy Growth and among themselves. This makes for an ideal environment for innovation, synergy and value creation across the entire Canopy Rivers ecosystem.

Canopy Rivers (TSX.V: RIV); (OTC: CNPOF) is Developing a Diversified International Cannabis Ecosystem

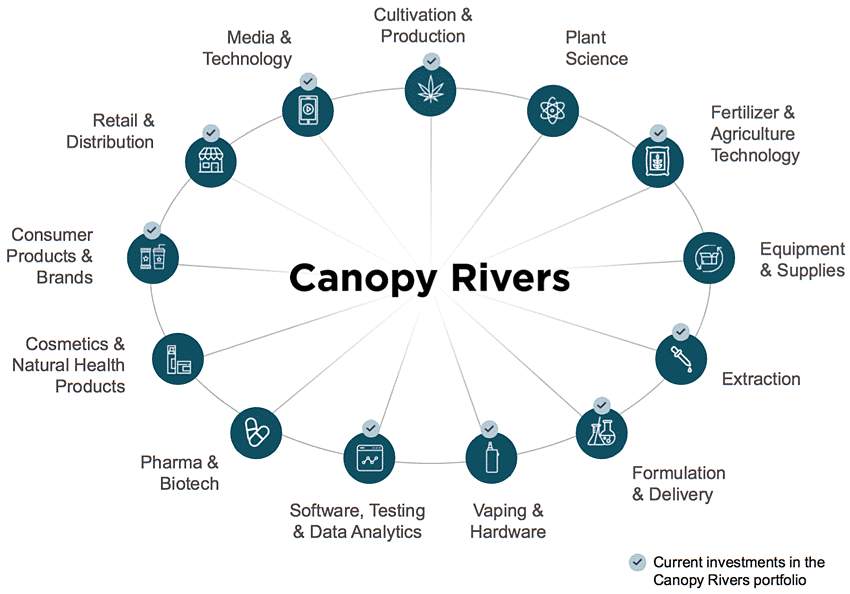

Canopy Rivers (TSX.V: RIV); (OTC: CNPOF) has quickly established a diversified portfolio of cannabis industry investments that includes:

- licensed producers…

- late stage applicants…

- pharmaceutical formulators…

- brand developers & distributors…

- consumer products and brands…

- and technology & media platforms.

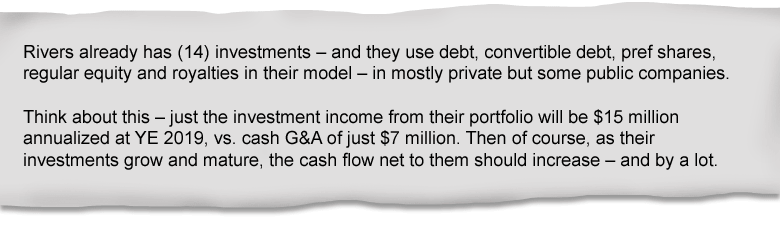

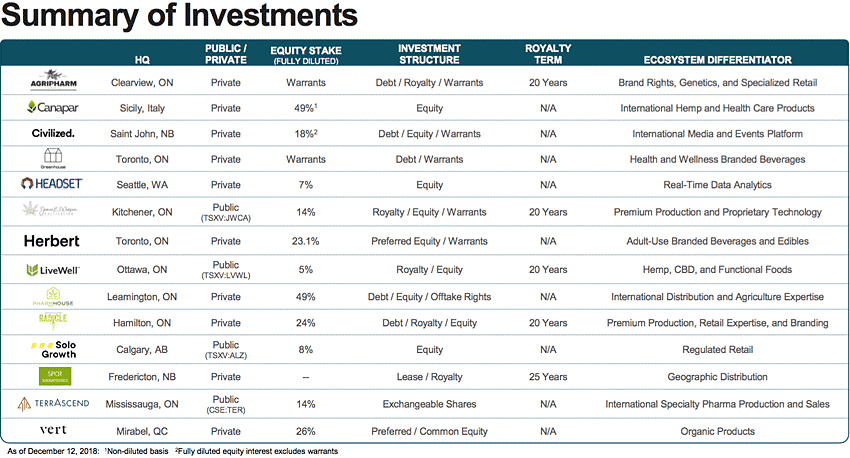

Canopy Rivers’ investments are customized for each company and include a balanced mix of equity, debt, royalty and profit sharing agreements.

Simply put, Canopy Rivers (TSX.V: RIV); (OTC: CNPOF) is a venture capital investment platform that also has royalty cash flow attached to it.

As a clear leader in the global cannabis industry, Canopy Rivers offers potential partners more than just access to capital for expansion.

Access private and public companies management believes are the “Best in Class” operators in the Cannabis Space with One Simple Investment: Canopy Rivers Inc. (TSX.V: RIV); (OTC: CNPOF)

For up-and-coming cannabis companies, a strategic partnership with Canopy Rivers brings a unique opportunity to potentially access the international platform of the world’s largest cannabis company – Canopy Growth Corporation.

These partners receive more than just capital – they also receive critical support and access to senior management and top employees at Canopy Growth Corporation to help nurture and guide the company to success.

For individual investors, investing with Canopy Rivers provides several advantages – in differentiation, clarity and expertise – over traditional cannabis stocks that are almost unfair.

Differentiation – The investment universe – especially in the cannabis space – is very broad, and can be difficult for investors to track, evaluate and differentiate.

But an investment in Canopy Rivers (TSX.V: RIV); (OTC: CNPOF) can help investors diversify their investment in the cannabis space by providing access to private companies that may offer global exposure…or that may be in a segment of the industry still in its early growth stages.

Clarity – How does an individual investor decide which up-and-coming companies in the cannabis space are worthy of investment? And how can investors gain exposure to companies in many areas of the emerging areas of the cannabis space that might not be publicly traded?

An investment in Canopy Rivers offers “access to private and public cannabis and cannabis-related operators it believes are best in class in the space” – including companies that are not yet publicly traded – that have been carefully evaluated by the team of financial and technical experts at Canopy Rivers for their upside potential.

Expertise – The financial professionals that are a part of the Canopy Rivers team – combined with the cannabis expertise developed by Canopy Growth Corporation – provide a critical advantage when evaluating the strength of a potential investment. They are combing the world looking for best-in-class companies to invest in.

What makes this such an “unfair” advantage is that no other venture capital firm on the planet has the resources, experience and expertise of Canopy Growth behind it.

Canopy Rivers (TSX.V: RIV); (OTC: CNPOF) Offers a Growing, Diversified Portfolio with High Upside Potential

Canopy Rivers (TSX.V: RIV); (OTC: CNPOF) currently has a portfolio of 14 companies – some of which are public and some which may go public in the future.

One of the company’s latest additions to the portfolio – Headset – is the first real-time business intelligence and analytics software platform for the cannabis industry. Headset’s experienced leadership team have deep roots in the cannabis industry having also founded Leafly, the world’s largest cannabis information resource.

With services that provide access to up-to-the-minute information on sales trends, emerging sectors, popular products, and pricing, Headset’s proprietary software platform allows customers to use data to identify new areas of opportunity, understand the competition, and tailor product development.

This is a portfolio of diversified investments including licensed producers, late stage applicants, pharmaceutical formulators, brand developers, distributors and media platforms.

1) Unique Investment Vehicle – Canopy Rivers (TSX.V: RIV); (OTC: CNPOF) offers investors a unique vehicle for accessing what management believes to be the best up-and-coming companies in the next phase of the global cannabis revolution.

1) Unique Investment Vehicle – Canopy Rivers (TSX.V: RIV); (OTC: CNPOF) offers investors a unique vehicle for accessing what management believes to be the best up-and-coming companies in the next phase of the global cannabis revolution.

2) Premier Strategic Partner in Canopy Growth Corporation – No other venture capital firm can offer investors access to the expertise of the world’s largest and leading cannabis company, Canopy Growth Corporation. Each company added to the Canopy Rivers portfolio may benefit from the experience, expertise and guidance of Canopy Growth Corporation every step of the way.

3) Diversified Platform – An investment in Canopy Rivers (TSX.V: RIV); (OTC: CNPOF) provides access to a number of companies – across the entire cannabis ecosystem – in a way that brings unrivaled diversification to the individual investor.

4) Strong Growth Profile – The companies hand-picked by Canopy Rivers for investment offer high upside potential in unique and specialized growth verticals and industry niches. The 14 companies in Canopy Rivers’ current portfolio not only benefit from the capital infusion by Canopy Rivers but also from potential collaboration within the ecosystem.

5) Experienced Leadership Team – Canopy Rivers (TSX.V: RIV); (OTC: CNPOF) is led by CEO and Chairman Bruce Linton – the cannabis pioneer who founded Tweed Marijuana and is currently CEO of Canopy Growth Corporation. The highly experienced management team is complemented by a diverse, forward-thinking board of directors that offers strong corporate governance practices and experience across a wide range of industries.

i https://www.forbes.com/sites/nickkovacevich/2019/01/02/budding-cannabis-trends-in-2019/#37851c6c586f

ii http://fortune.com/2018/12/27/legal-marijuana-industry-sales/

iii https://arcviewgroup.com/

Disclaimer: This release/advertorial is a commercial advertisement and is for general information purposes only. This is a Native Advertisement, meaning it is an informational paid marketing piece. MarijuanaStox.com makes no recommendation that the securities of the companies profiled or discussed on this website should be purchased, sold or held by viewers that learn of the profiled companies through our website. Please review all investment decisions with a licensed investment advisor. This Advertorial was paid for by Canopy Rivers in an effort to enhance public awareness of Canopy Rivers and its securities. DF Media has or expects to receive one hundred twenty five thousand Canadian dollars by Canopy Rivers as a total production budget for this advertising effort. Neither MarijuanaStox.com or DF Media currently holds the securities of Canopy Rivers . and does not currently intend to purchase such securities. This Advertorial contains forward-looking statements that involve risks and uncertainties. This Advertorial contains or incorporates by reference forward-looking statements, including certain information with respect to plans and strategies of the featured Company. As such, any statements contained herein or incorporated herein by reference that are not statements of historical fact may be deemed to be forward-looking statements. Without limiting the foregoing, the words “believe(s)” “anticipate(s)”, “plan(s)” “expect(s)” “project(s)” “will” “make” “told” and similar expressions are intended to identify forward-looking statements. There are a number of important factors that could cau se actual events or actual results of the Company to differ materially from these indicated by such forward-looking statements. Certain statements contained herein constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and 21E of the Exchange Act of 1934. Such statements include, without limitation, statements regarding business, financing, business trends, future operating revenues and expenses. There can be no assurance that such expectations will prove to be correct. Investors are cautioned that any forward-looking statements made by the Company, or contained in this advertorial are not guarantees of future performance, and that the Issuer’s actual results may differ materially from those set forth in the forward-looking statements. Difference in results can be caused by various factors including, but not limited to, the Company’s ability to be able to successfully complete planned funding agreements, to successfully market its products in competitive industries or to effectively implement its business plan or strategies. To reiterate, information presented in this advertorial contains “forward-looking statements”. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions, or future events or performance are not statements of historical fact and may be “forward-looking statements.” Forward-looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward-looking statements in this advertorial may be identified through the use of words such as “expects,” “will,” “anticipates,” “estimates,” “believes,” “may,” or by statements indicating certain actions “may,” “could,” or “might” occur. More information on the Company may be found at www.sec.gov readers can review all public filings by the Company at the SEC’s EDGAR page. MarijuanaStox.com is not a certified financial analyst or licensed in the securities industry in any manner. The information in this Advertorial is a subjective opinion and may not be complete, accurate, or current and was paid for, so this could create a conflict of interest.