With Proven Organic Growth and Brand Expertise, the Team Leading Rubicon Organics (CSE: ROMJ); (OTC: ROMJF) Offers Investors an Unparalleled Opportunity

These Certified Organic Cannabis Experts Helped Build Whistler Medical Marijuana into a C$175 Million Acquisition by Aurora Cannabis…Here’s Why Their Next Project Could Be Even More Lucrative

This one could have massive upside potential.

In the midst of a rapidly growing legal cannabis market, one Canadian company – Rubicon Organics (CSE: ROMJ); (OTC: ROMJF) – has quickly emerged as a unique, high-upside play.

That’s because – unlike many of today’s fast-moving cannabis companies run by investment bankers – Rubicon Organics is led by executives with a history of successful organic cannabis cultivation and building super-premium brands.

These executives include the organic cannabis pioneers behind Whistler Medical Marijuana Corp. (WMMC) and brand-builders who helped lead famous brands such as Red Bull, Diageo, and Proctor & Gamble.

It’s that expertise – and proven experience bringing super-premium brands to market – that makes Rubicon Organics (CSE: ROMJ); (OTC: ROMJF) such an attractive investment to consider in this rapidly-growing market.

In fact, the co-founders of Rubicon Organics – Jesse McConnell and Peter Doig – helped build Whistler Medical Marijuana Corp. (WMMC) from ground up…becoming Canada’s first certified organic cannabis producer…

And then ultimately being acquired by Aurora Cannabis in January 2019 for C$175 million!

At the time WMMC was acquired for C$175 million, the company had a cultivation capacity of just 5,000 kg.

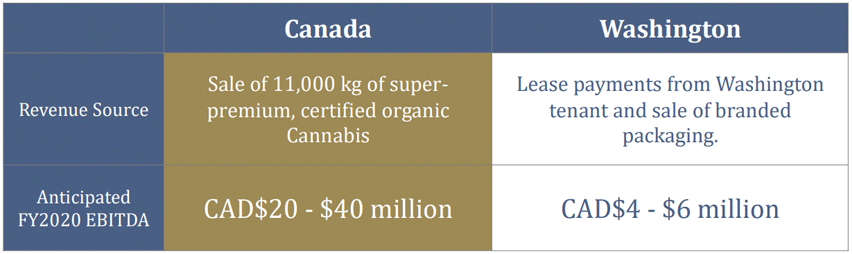

These organic cannabis pioneers are aiming to have their latest venture – Rubicon Organics (CSE: ROMJ); (OTC: ROMJF) – cultivate 11,000 kg in 2020…more than double the capacity of Whistler Medical!

In fact, the reason Rubicon Organics was founded by Jesse and Peter was because they believed organic cannabis could be cultivated at scale in hybrid greenhouses at a fraction of the WMMC’s high indoor cultivation costs.

And they have now proven this concept in Washington State, where their proprietary organic cultivation methodologies are being applied to grow super-premium cannabis that is being sold under super-premium brand names selling at US$15 per gram.

Here’s how this scenario is now unfolding…

Here’s how this scenario is now unfolding…

Canada’s Rapidly Growing Cannabis Market Offers Investors Significant Growth Potential

No question about it – Canada’s legal cannabis market is still in the early stages of a massive growth phase.

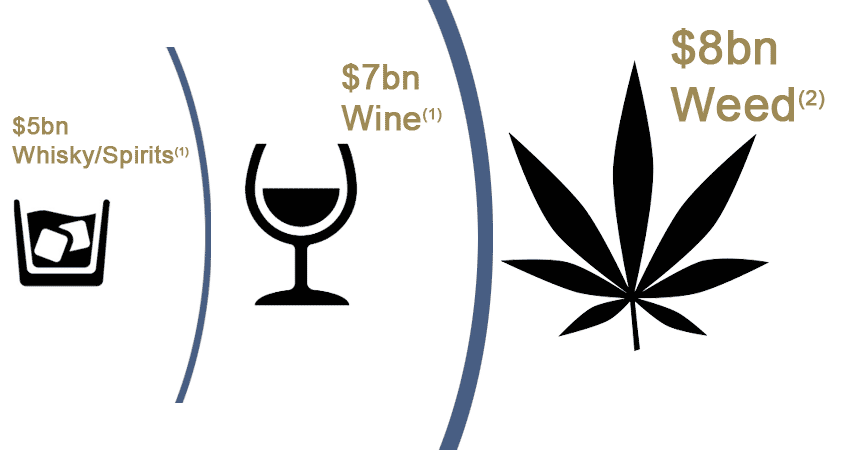

According to industry experts, the Canadian cannabis market is currently worth $5.7 billion CDN…and is projected to grow to more than $8 billion CDN by 2022.

This would make the marijuana market larger than other recreational industries in Canada, including the $5 billion whiskey/spirits market and the $7 billion wine market.

This extraordinary market growth has already attracted a great deal of attention from investors.

But as more players enter the market, the challenge for investors is to find a cannabis investment that stands apart from the competition.

Another key differentiator for Rubicon Organics (CSE: ROMJ); (OTC: ROMJF) is the Company’s focus on organic certification.

Organic, Super-Premium Cannabis Commands Significant Price Premium

Rubicon Organics (CSE: ROMJ); (OTC: ROMJF) is a Canadian Licensed Producer focused on the organic, super-premium cannabis market.

In July 2019, the Company received an organic certification from the Fraser Valley Organic Producers Association (FVOPA) for its 125,000-square-foot hybrid greenhouse facility in British Columbia.

In July 2019, the Company received an organic certification from the Fraser Valley Organic Producers Association (FVOPA) for its 125,000-square-foot hybrid greenhouse facility in British Columbia.

This made Rubicon Organics one of just two cannabis companies in Canada to be certified by FVOPA (with the first company being WMMC – ring a bell?)

Rubicon Organics is a rare combination of:

- Unparalleled cannabis and organic farming expertise

- Prior successful commercialization of cannabis

- High-tech hybrid facilities that produce at lower costs

- Extensive CPG brand-building proficiency

By combining top-shelf quality cannabis with an experienced Consumer Packaged Goods (CPG) team, Rubicon Organics intends to establish the most exclusive cannabis brands in Canada.

Why is focusing on the super-premium market so important?

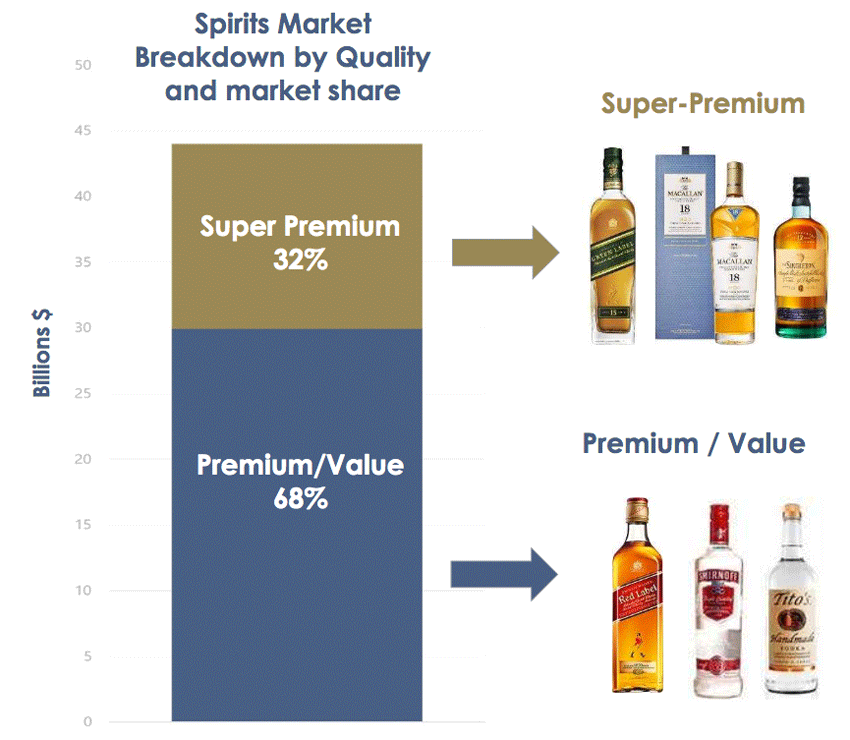

Look no further than the spirits market for a prime example, where George Clooney and his partners built a super-premium tequila brand – Casamigos – into a company that sold for $1 billion just five years after being founded.

Look no further than the spirits market for a prime example, where George Clooney and his partners built a super-premium tequila brand – Casamigos – into a company that sold for $1 billion just five years after being founded.

The super-premium category of the spirits market accounts for 32% of all sales…and is growing at a compound annual growth rate (CAGR) of 3.8x to that of the premium category.

This extraordinary growth is due to the desire of consumers – in particular millennials – to bypass the value and premium liquor store shelves in search of high-end, super-premium products.

That same type of consumer that has driven the super-premium spirits market higher – those who demand a high-grade product – is who Rubicon Organics is built for.

Rubicon Organics is taking a CPG approach to brand development by designing a unique and captivating consumer narrative, backed by the superior quality of its certified organic product.

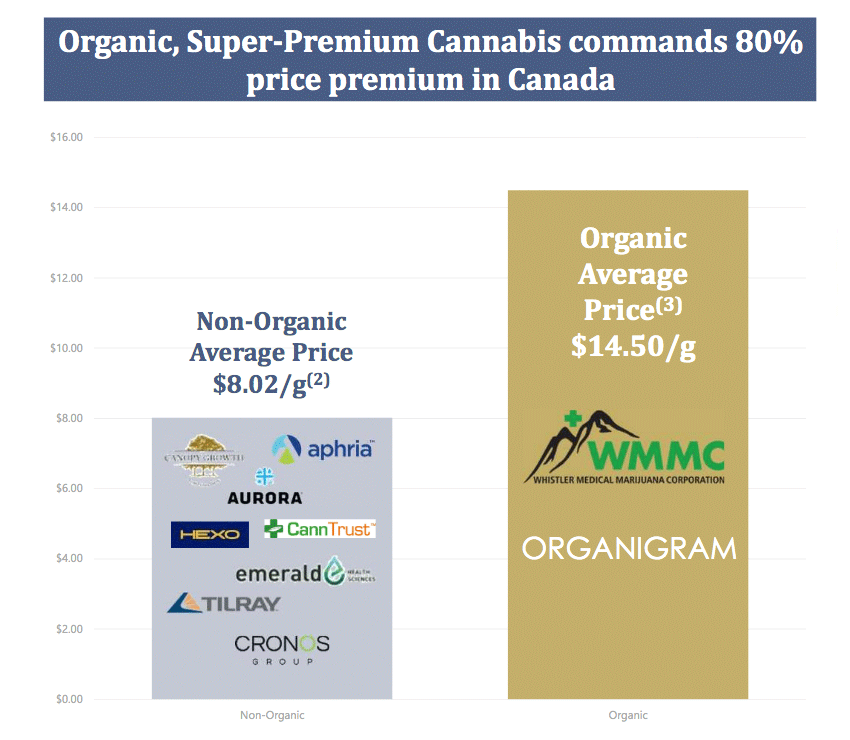

Over 47% of Canadian cannabis consumers prefer an organically grown product.

And super-premium, organic products have already been shown to command a significant price premium – as high as 80% — in Canada.

In addition, out of the more than 200 Licensed Producers in Canada, there are less than five certified organic producers…and only a handful focused in the super-premium category.

This gives Rubicon Organics a significant potential first-to-market advantage in the high-margin, super-premium cannabis space.

Rubicon Organics (CSE: ROMJ); (OTC: ROMJF) Delivers Small-Batch Excellence with Large-Scale Execution

Rubicon Organics was founded in 2015 by two pioneers in the organic cannabis cultivation space: Jesse McConnell and Peter Doig.

Following their successful organic cultivation experience with Whistler Medical Marijuana Corp. (WMMC), the pair founded Rubicon Organics to replicate super-premium, organic indoor production quality on a commercial scale and in an environmentally stable way.

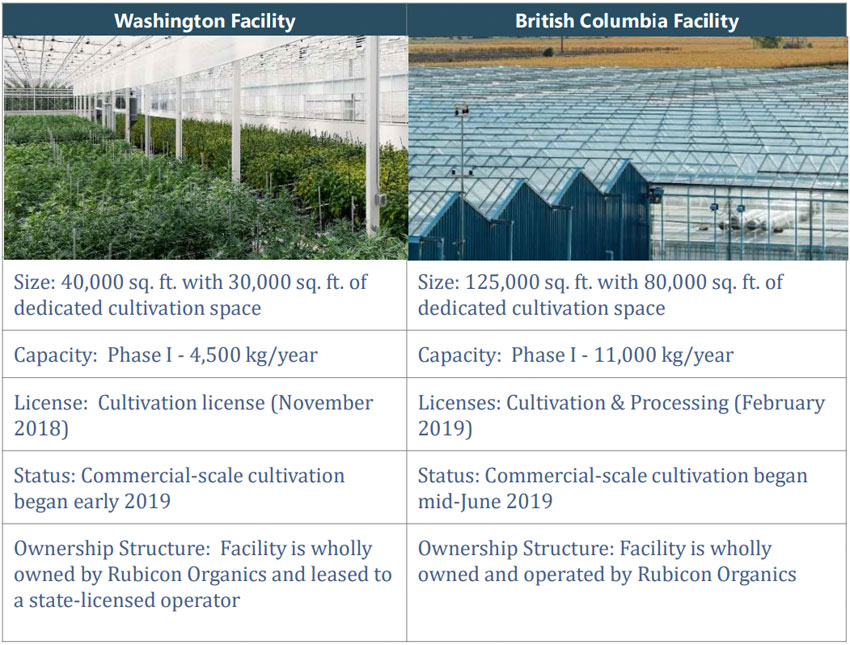

The Company built the first of its kind, state-of-the-art hybrid greenhouse in Washington State in 2017. This 40,000 square foot facility is now leased to a state-licensed operator that is applying Rubicon Organics’ organic cultivation intellectual property.

Rubicon Organics’ second facility, in Delta, British Columbia, was acquired in late 2017 and retrofitted in 2018 to become another state-of-the-art hybrid greenhouse.

And the Company’s organic cultivation IP has already been proven successful in Washington State, where the facility completed its first harvest of super-premium, organic cannabis at scale in April 2019.

That product is being sold in Washington under the super-premium brand SubX, which retails for US $15 per gram.

The superior quality of the cannabis grown at this facility – and using Rubicon Organics’ proprietary IP – led to licensing agreements with the iconic California super-premium cannabis brand, Cookies.

The Most Impressive Margins in the Cannabis Industry

* Rubicon Organics’ goal is to produce ultra-premium quality cannabis at unbeatable operational costs of 33% to 50% less than indoor operations.

* In Canada, the Company is working toward achieving cultivation costs of $0.50 per gram – an industry low cost for super-premium organic cannabis.

* Combined with the premium retail prices of $14 to $20 per gram commanded by super-premium, certified organic products, the Company could potentially achieve some of the highest margins in the North American cannabis industry.

Rubicon Organics is Led By Pioneers in Organic Cannabis Cultivation and CPG Branding

Rubicon Organics has demonstrated an ability to produce an incredible product…so the question is: Can they turn this extraordinary product into a profitable brand?

One quick look at the experienced team leading this company provides the answer to that question.

While many of the companies seeking investor attention in the cannabis space are currently led by investment bankers – with no significant real-world cannabis experience – Rubicon Organics offers a superior alternative.

That’s because Rubicon Organics (CSE: ROMJ); (OTC: ROMJF) is led by a team of industry experts who have successfully built certified organic cannabis companies in the past…and also by proven brand builders who have helped lead some of the world’s most widely-recognized brands.

These dynamic leaders include…

Jesse McConnell – Chief Executive Officer and Co-Founder

Jesse McConnell – Chief Executive Officer and Co-Founder

* 15 years of cultivation and consulting experience in the medical marijuana field.

* Co-founded Whistler Medical Marijuana Corp. (“WMMC”) and was instrumental in that company’s license application process with Health Canada. Oversaw the design and construction of the facility and workflows and co-developed the cultivation system, including its conversion to organic cultivation.

* WMMC became Canada’s first certified organic cannabis producer and was acquired by Aurora Cannabis in January 2019 for C$175 million.

Peter Doig – Chief Scientific Officer and Co-Founder

Peter Doig – Chief Scientific Officer and Co-Founder

* Over 10 years of experience in organic cultivation, including six years refining and perfecting organic cannabis cultivation methods.

* Chief Agronomist for six years conducting award-winning R&D at Origin O, one of the largest organic tomato greenhouses in North America.

* Developed the organic cannabis cultivation methodology at WMMC that proved organic cultivation can generate yields comparable with non-organic cultivation.

* Recognized expert for organic cannabis cultivation who wrote the Certified Organic Cannabis Standard in Canada (FVOPA).

Tim Roberts – President, North America

Tim Roberts – President, North America

* Brings over 20 years of experience working across luxury, CPG and food & beverage industries around the world.

* Has extensive expertise related to marketing in highly regulated industries and is known for driving commercial rigor throughout the P&L for maximum growth potential.

* Has held senior leadership positions at Red Bull (South America, Caribbean, New Zealand), Diageo (Africa), Innocent Drinks (UK) and Procter & Gamble (UK).

Melanie Ramsey – VP Marketing and Innovation

Melanie Ramsey – VP Marketing and Innovation

* Has over 20 years of innovation and brand building experience for globally renowned CPG companies.

* Brings to the Company a proven track record of developing successful brands in a rapidly evolving industry.

* Has held senior leadership positions at Diageo, Beiersdorf and The Body Shop.

Margaret Brodie, CPA, CA – Chief Financial Officer and Director

Margaret Brodie, CPA, CA – Chief Financial Officer and Director

* Brings over 20 years of finance experience to the Company, including a notable 10-year tenure with KPMG.

* Is an experienced CFO of several public companies and holds a CPA, CA designation in Canada.

7 Key Reasons Investors Should Consider Rubicon Organics (CSE: ROMJ); (OTC: ROMJF) Today

1) Founded by Industry Pioneers – Rubicon Organics (CSE: ROMJ); (OTC: ROMJF) is NOT led by a group of investment bankers with limited experience. Instead, Rubicon Organics is led by the organic cannabis pioneers behind Whistler Medical Marijuana Corp. (WMMC) and brand-builders who helped lead famous brands such as Red Bull, Diageo, and Proctor & Gamble.

2) High Margin Potential – By focusing on the super-premium category, Rubicon Organics looks to tap into premium retail prices as high as $20 per gram commanded by super-premium, certified organic products. Combined with its industry-low growth costs, the Company could potentially achieve some of the highest margins in the North American cannabis industry.

3) Rubicon Organics Appears Significantly Undervalued – With a market cap currently around $95 million – and a projected EBITDA of between $20-$45 million – an investment in Rubicon Organics (CSE: ROMJ); (OTC: ROMJF) would appear to offer significant upside to investors compared to many of the more established names in the industry.

4) Proven Organic Cultivation IP – Rubicon Organics’ proprietary cultivation IP has already been proven successful in Washington State…and the superior quality of the cannabis grown at its facility has led to licensing agreements with the iconic California super-premium cannabis brand, Cookies.

5) Certified Organic Cannabis – Rubicon Organics is one of only two cannabis companies to receive an organic certification from the Fraser Valley Organic Producers Association (FVOPA). Over 47% of Canadian cannabis consumers prefer an organically grown product.

6) First-to-Market Advantage – Out of the more than 200 Licensed Producers in Canada, there are less than five certified organic producers…and only a handful focused in the super-premium category. This gives Rubicon Organics a significant potential first-to-market advantage in the high-margin, super-premium cannabis space.

7) Significant Insider Buying – Rubicon Organics’ company insiders have been consistent and frequent buyers of ROMJ shares in the open market. When insiders are consistently buying stock – and putting their money where their mouth is – investors can feel confident about the near- and long-term potential for that company.

Disclaimer: This release/advertorial is a commercial advertisement and is for general information purposes only. This is a Native Advertisement, meaning it is an informational paid marketing piece. MarijuanaStox.com makes no recommendation that the securities of the companies profiled or discussed on this website should be purchased, sold or held by viewers that learn of the profiled companies through our website. Please review all investment decisions with a licensed investment advisor. This Advertorial was paid for by Rubicon Organics in an effort to enhance public awareness of Rubicon Organics and its securities. DF Media has or expects to receive over one thousand dollars for PPC by Rubicon Organics as a total production budget for this advertising effort. Neither MarijuanaStox.com or DF Media currently holds the securities of Rubicon Organics . and does not currently intend to purchase such securities. This Advertorial contains forward-looking statements that involve risks and uncertainties. This Advertorial contains or incorporates by reference forward-looking statements, including certain information with respect to plans and strategies of the featured Company. As such, any statements contained herein or incorporated herein by reference that are not statements of historical fact may be deemed to be forward-looking statements. Without limiting the foregoing, the words “believe(s)” “anticipate(s)”, “plan(s)” “expect(s)” “project(s)” “will” “make” “told” and similar expressions are intended to identify forward-looking statements. There are a number of important factors that could cau se actual events or actual results of the Company to differ materially from these indicated by such forward-looking statements. Certain statements contained herein constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and 21E of the Exchange Act of 1934. Such statements include, without limitation, statements regarding business, financing, business trends, future operating revenues and expenses. There can be no assurance that such expectations will prove to be correct. Investors are cautioned that any forward-looking statements made by the Company, or contained in this advertorial are not guarantees of future performance, and that the Issuer’s actual results may differ materially from those set forth in the forward-looking statements. Difference in results can be caused by various factors including, but not limited to, the Company’s ability to be able to successfully complete planned funding agreements, to successfully market its products in competitive industries or to effectively implement its business plan or strategies. To reiterate, information presented in this advertorial contains “forward-looking statements”. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions, or future events or performance are not statements of historical fact and may be “forward-looking statements.” Forward-looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward-looking statements in this advertorial may be identified through the use of words such as “expects,” “will,” “anticipates,” “estimates,” “believes,” “may,” or by statements indicating certain actions “may,” “could,” or “might” occur. More information on the Company may be found at www.sec.gov readers can review all public filings by the Company at the SEC’s EDGAR page. MarijuanaStox.com is not a certified financial analyst or licensed in the securities industry in any manner. The information in this Advertorial is subjective opinion and may not be complete, accurate or current and was paid for, so this could create a conflict of interest.