Black Ace Organigram Holdings Inc. (NASDAQ:OGI) (TSX.V:OGI) Has Highest-Tier Financials and is Primed for Expansion in 2019

This company’s stock has been on a tear since May 9th trading from a low of CAD $9.00 and closing on May 17th at CAD $10.72. That’s an eye-popping 19.11% increase!

As the Canadian pot market evolves, the biggest companies are beginning to either devour or crush the smaller ones[1], a sign of an industry’s move towards maturity.

One late-comer who has become a standout from the pack is Organigram Holdings Inc. (NASDAQ:OGI) (TSX.V:OGI) — the almost 2 billion-dollar market cap licensed producer with a foothold in all ten Canadian provinces, that is flying under the radar.

One late-comer who has become a standout from the pack is Organigram Holdings Inc. (NASDAQ:OGI) (TSX.V:OGI) — the almost 2 billion-dollar market cap licensed producer with a foothold in all ten Canadian provinces, that is flying under the radar.

A black ace for the sector, Organigram has some of the best financials in the industry. Producing high-quality dried flower at an ultra-low cost, the company is built upon a state-of-the-art facility, with strategic partnerships that position them for a significant early-mover advantage for what’s being called Pot 2.0—edibles and derivative-based products.

With the lowest cost-per-gram production costs in the country, Organigram is in 9 provinces and expects to finalize registration in the near future with the tenth province making it one of only four pot companies with a foothold in every Canadian province.

With the lowest cost-per-gram production costs in the country, Organigram is in 9 provinces and expects to finalize registration in the near future with the tenth province making it one of only four pot companies with a foothold in every Canadian province.

Based out of the Maritime province of New Brunswick in Eastern Canada, the Company’s innovative three-tier cultivation technology utilizes space better than any other in its class, Organigram is poised to take full advantage of its Canada-wide distribution strength.

The company’s well positioned for expansion and new product development, especially ahead of the upcoming legalization of edibles and derivative-based products expected in October 2019[2].

Highest-Tier Financials With High-Quality Product, for Lowest Cost Per-Gram

Organigram Holdings Inc. Is Set For Expansion in 2019

Get Their Latest Press Releases Delivered To Your Inbox

Bonus: Sign Up Now and Get Your Free 2019 Pot Investor Guide

One of Only FOUR Canadian LPs with a Foothold in all 10 Provinces

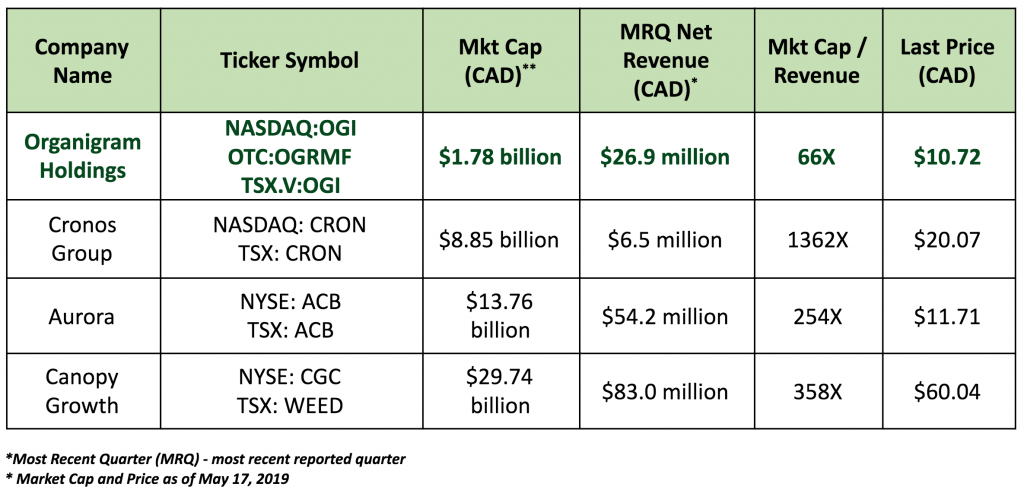

With the limited distinction of being the lowest cost producer among all Canadian licensed pot producers, Organigram Holdings Inc. (NASDAQ:OGI) (TSX.V:OGI) is considered a black ace in the field, but if you look at their market cap divided by their revenue, they are trading at a much lower market cap compared to their peers by quite a large margin. Aurora is trading at 254X, which is the closest comparison to Organigram. At 254X, Organigram would have a market cap of $6.8 billion.

Highest-Tier Financials with High-Quality Product, for Lowest Cost Per-Gram

Perhaps the most glaring advantage of Organigram Holdings Inc. (NASDAQ:OGI) (TSX.V:OGI) is its low cost per-gram (lower than any major LP). However, the low cost hasn’t negatively impacted the quality.

On the contrary…

Organigram has won top accolades in the sector, including taking home awards for Top (Strain)and Compassionate Pricing at the 2017 Canadian Pot Awards. Thanks to their low cost per gram operations, Organigram can price compassionately for the medical market.

Organigram has won top accolades in the sector, including taking home awards for Top (Strain)and Compassionate Pricing at the 2017 Canadian Pot Awards. Thanks to their low cost per gram operations, Organigram can price compassionately for the medical market.

Via their high-tech indoor facility in Moncton, New Brunswick, Organigram Holdings Inc. (NASDAQ:OGI) (TSX.V:OGI) has achieved a cash cost per gram of C$0.65/gram and an all-in cost of C$0.85/gram in its second quarter —This is lower than any of their competitors.

This is done by maximizing yields per square foot and operating year-round, thanks to the 3-level indoor growing system.

These low costs delivered the company a stunning Q2 2019, with financial results that set the pace for its competitors[3].

In first full quarter of adult-use recreational sales, Organigram’s net revenue for Q2 2019 was $26.9 million, divided into $24.5 million from recreational, and $2.4 million from medical. This output can also be broken down into 4,248kg of dried flower and 5,735L of oils.

The results are astounding when one notices Organigram Holdings Inc.’s (NASDAQ:OGI) (TSX.V:OGI) adjusted gross margin of $16 million in Q2 2019—a whopping 60%!

It doesn’t end there. The company’s adjusted EBITDA was $13.3 million, translating to a margin of 49%.

Moving forward, Organigram has five brands ranging from value to premium in the pipeline. Through this, they can cater to all segments of the market due to the ability to control all variables. Using this product line, any matter that doesn’t meet the standards for their budget brand can be used as biomass for extracts.

This has all pointed towards Organigram’s up-listing to the NASDAQ—joining the likes of Cronos Group Inc., Tilray Inc., and Village Farms International, Inc.

Highest-Tier Financials With High-Quality Product, for Lowest Cost Per-Gram

Organigram Holdings Inc. Is Set For Expansion in 2019

Get Their Latest Press Releases Delivered To Your Inbox

Bonus: Sign Up Now and Get Your Free 2019 Pot Investor Guide

Triple-Play, State-Of-The-Art Technology

Organigram Holdings Inc. (NASDAQ:OGI) (TSX.V:OGI) utilizes 3-level indoor growing technology that enables complete year-round climate control for maximum yield and quality—and is the ONLY major Canadian licensed producer of pot using this method.

By using the 3-level system, Organigram gains maximum capacity on its space and an advantage over other companies with the same footprint.

Through strategic planning, the company has also set the foundation for major expansions without the long approval wait times experienced by some of its competitors. Among its upcoming expansionary plans are the addition of state-of-the-art extraction capacity and its own edibles facility.

By the end of 2019, Phase 4 of the expansions are expected to increase Organigram’s cultivation capacity to 113,000kg/yr (249,000 lbs). This phase’s improvements include a state-of-the-art mechanical system and an enhanced irrigation system that’s expected to be one of the most sophisticated in North America.

Phase 5 goes even further, giving Organigram Holdings Inc.’s (NASDAQ:OGI) (TSX.V:OGI) capabilities for state-of-the-art derivative and edibles production facilities, in preparation for the upcoming legalization of these products expected in October 2019—The phase is expected to be substantially completed in time for October.

Phase 5 goes even further, giving Organigram Holdings Inc.’s (NASDAQ:OGI) (TSX.V:OGI) capabilities for state-of-the-art derivative and edibles production facilities, in preparation for the upcoming legalization of these products expected in October 2019—The phase is expected to be substantially completed in time for October.

Unlike several companies in the sector that have made projections and fallen short, Organigram has a history of executing. This helps the credibility of the company’s expansion plans.

Highest-Tier Financials With High-Quality Product, for Lowest Cost Per-Gram

Organigram Holdings Inc. Is Set For Expansion in 2019

Get Their Latest Press Releases Delivered To Your Inbox

Bonus: Sign Up Now and Get Your Free 2019 Pot Investor Guide

Expected in Q3 2019, Organigram Holdings Inc. (NASDAQ:OGI) (TSX.V:OGI) is currently awaiting an R&D license to confirm and assess a shelf-stable, water-soluble, tasteless pot beverage product formulation that provides onset within 10-15 minutes. This shorter onset provides the potential for easier dose control. Perhaps the biggest issue with edibles is the inability to control dosage due to longer onset and duration of effect.

Because formulations with similar molecular size are absorbed through the bloodstream (not processed via the liver), they result in a shorter onset.

Organigram has also partnered with Hyasynth, a leader in pot science and biosynthesis, a process which produces pure pot at a fraction of traditional cultivation costs, without growing the plant.

Organigram has also partnered with Hyasynth, a leader in pot science and biosynthesis, a process which produces pure pot at a fraction of traditional cultivation costs, without growing the plant.

The potential for this innovation could be enormous on a global scale. By inserting genes into the natural metabolism of yeast, the process aims to produce within the yeast. Through this patented IP, production can be scaled to millions of liters of pot producing fermentation.

Strategic Partnerships and Licensing Advantages Ahead of Edibles and Extracts Legalization (Pot 2.0)

Long-term planning has always been part of the strategy of Organigram Holdings Inc. (NASDAQ:OGI) (TSX.V:OGI). Due to the modular way the company has established its expansion plans, future licensing should be streamlined and as simple as amending their current license.

As the company expands its cultivation and processing capacities, Organigram will only have to piggyback on its current buildings and licenses and apply for amendments.

As the company expands its cultivation and processing capacities, Organigram will only have to piggyback on its current buildings and licenses and apply for amendments.

Given this existing streamlined licensing process, and its established relationship with Health Canada, Organigram has a significant advantage over much of the competition.

Prior to this anticipated round of legalizations, Organigram Holdings Inc. (NASDAQ:OGI) (TSX.V:OGI) has established partnerships with innovators Hyasynth, The Green Solution (TGS), Valens GroWorks, and Canada’s Smartest Kitchen.

Through these partnerships, Organigram will be working to develop commercial-scale extraction and product processing, beverages, premium chocolate products, and other edibles.

Perhaps the largest potential could come from Organigram’s investment in leading pot science and biosynthesis biotech company, Hyasynth. The company has developed a disruptive technology to naturally produce pot without growing the plant.

This could potentially revolutionize the entire industry.

The process has the potential to create a global supply of pure pot-derivatives at a fraction of the cost of traditional cultivation. It involves inserting genes into yeast’s natural metabolism causing the production within the yeast. Through this process, Hyasynth has developed patented enzymes that convert from natural precursors to derivatives. According to the design, each new yeast strain can be scaled to make millions of liters of fermentation.

With Canada’s Smartest Kitchen, Organigram Holdings Inc. (NASDAQ:OGI) (TSX.V:OGI) has partnered to develop premium chocolate products and expand edibles R&D. Through a partnership with Valens to build up extraction materials for conversion to concentrate for vapes, edibles. This started with shipping 4,200 kg of materials to Valens, resulting in initial shipments of concentrate already received back.

Along with its own upcoming Canadian Extraction facility expansion plans, Organigram is partnered with The Green Solution to further optimize commercial-scale extraction and product processing while progressing on derivative product development.

Highest-Tier Financials With High-Quality Product, for Lowest Cost Per-Gram

Organigram Holdings Inc. Is Set For Expansion in 2019

Get Their Latest Press Releases Delivered To Your Inbox

Bonus: Sign Up Now and Get Your Free 2019 Pot Investor Guide

Management Brings Diverse Wealth of Relevant Experience

Key to the makeup of the Organigram Holdings Inc. (NASDAQ:OGI) (TSX.V:OGI) team, is the diverse backgrounds of each member, which brings a variety of strengths to the table. The team not only has relevant sector-specific expertise, but also is complemented with talents from other branding and marketing efforts for diverse products such as pharmaceuticals, consumer packaged goods (CPGs) and alcoholic beverages.

Together, the team has compiled many decades of combined experience in their fields, and shares the company’s goal of providing a high-quality product, at industry leading low costs of production.

Here’s a quick look at some of the key figures behind Organigram Holdings Inc. (NASDAQ:OGI) (TSX.V:OGI):

The company is led by Chief Executive Officer, Greg Engel, whose 30 years of national and international experience includes pharmaceuticals, biotechnology, pot, and CPGs. Most recently, Engel served as CEO of Tilray Inc., where he was instrumental in the company becoming the first Canadian exporter of medical pot, as well as establishing several trailblazing industry standards. He brought this expertise to Organigram, where he’s focused the company on building reputational excellence through product quality and safety, and through the expansion of the flagship Moncton, NB facility. His efforts have helped to position Organigram as a leader in the Medical and Adult Recreational Pot industries.

The company is led by Chief Executive Officer, Greg Engel, whose 30 years of national and international experience includes pharmaceuticals, biotechnology, pot, and CPGs. Most recently, Engel served as CEO of Tilray Inc., where he was instrumental in the company becoming the first Canadian exporter of medical pot, as well as establishing several trailblazing industry standards. He brought this expertise to Organigram, where he’s focused the company on building reputational excellence through product quality and safety, and through the expansion of the flagship Moncton, NB facility. His efforts have helped to position Organigram as a leader in the Medical and Adult Recreational Pot industries.

Joining Engel are a trio of food and beverage industry experts, each serving different roles within the company.

Bringing over 25 years of experience to the role of Senior Vice President, Operations, Jeff Purcell is an expert in implementation of quality systems, safety, and continuous improvement initiatives. Most recently Purcell served as Vice President of Operations for Canada’s oldest candy company, Ganong Bros., where he was responsible for a significant facility expansion that essentially created an entirely new production environment. Prior to that role, he spent more than 15 years in career formation in progressively senior roles leading operations for McCain Foods.

Bringing over 25 years of experience to the role of Senior Vice President, Operations, Jeff Purcell is an expert in implementation of quality systems, safety, and continuous improvement initiatives. Most recently Purcell served as Vice President of Operations for Canada’s oldest candy company, Ganong Bros., where he was responsible for a significant facility expansion that essentially created an entirely new production environment. Prior to that role, he spent more than 15 years in career formation in progressively senior roles leading operations for McCain Foods.

Serving as Senior Vice President, Marketing and Communications, is Ray Gracewood, whose experience has built a reputation as a leading brand and marketing professional in Atlantic Canada. Previously as the Senior Director of Sales and Marketing for Moosehead Breweries Ltd., Gracewood established a reputation as a strong speaker on brand, packaging, and positioning, both locally and throughout North America. He specializes in building and developing brands, as well as positioning and segmentation.

Serving as Senior Vice President, Marketing and Communications, is Ray Gracewood, whose experience has built a reputation as a leading brand and marketing professional in Atlantic Canada. Previously as the Senior Director of Sales and Marketing for Moosehead Breweries Ltd., Gracewood established a reputation as a strong speaker on brand, packaging, and positioning, both locally and throughout North America. He specializes in building and developing brands, as well as positioning and segmentation.

As Senior Vice President, Sales and Commercial Operations, Tim Emberg fulfills the role of leading both the recreational and medical sales organizations, while ensuring Organigram is well established and represented strongly on a national level. Emberg is an accomplished, bilingual, senior sales and marketing leader, with a proven track record in healthcare, OTC and CPG organizations, including Roche Canada, Jamieson Laboratories, and Frito-Lay Canada. He brings an extensive knowledge of the Canadian market access and regulatory environments to the role, as well as will help to set the stage for the company’s future growth and development.

As Senior Vice President, Sales and Commercial Operations, Tim Emberg fulfills the role of leading both the recreational and medical sales organizations, while ensuring Organigram is well established and represented strongly on a national level. Emberg is an accomplished, bilingual, senior sales and marketing leader, with a proven track record in healthcare, OTC and CPG organizations, including Roche Canada, Jamieson Laboratories, and Frito-Lay Canada. He brings an extensive knowledge of the Canadian market access and regulatory environments to the role, as well as will help to set the stage for the company’s future growth and development.

5

Reasons

Organigram Holdings Inc. (NASDAQ:OGI) (TSX.V:OGI) is A Major Licensed Producer With The Highest-tier Financials

1

ONE OF ONLY FOUR LPs WITH A FOOTHOLD IN ALLl 10 PROVINCES

Keeping in great company with only Canopy, CannTrust and Aphria as peers, Organigram is a rare licensed producer that is in 9 Canadian provinces and expects to ship to the 10th in the near future. This gives them majority market capture in Canada, and with their low-cost operations they are set to compete as a front-runner.

2

STATE-OF-THE-ART TECHNOLOGY

Utilizing innovative 3-level growing technology, Organigram Holdings Inc. (NASDAQ:OGI) (TSX.V:OGI) can completely control climate for maximum yield and quality, year-round. They’re the only major Canadian LP to use the 3-level system, giving them more capacity than other companies with the same footprint. Soon with upcoming expansions, they’ll also have state-of-the-art extraction facilities, and Phase 4 will bring their capacity to 113,000kg/yr (249,000 lbs) by the end of 2019. They are also awaiting R&D licensing to test a shelf-stable, water-soluble, tasteless pot-infused beverage that provides initial onset within 10-15 minutes, and have a partnership with Hyasynth to produce pot without growing any plant material at a fraction of cultivation costs.

3

HIGHEST-TIER FINANCIALS, HIGH-QUALITY, LOWEST-COST PER GRAM

Among its peers, Organigram has won top accolades for its products, including taking home the Top Licensed Producer, and Compassionate Pricing honors at the 2017 Canadian Pot Awards. With an all-in cost of C$0.85/gram and a cash cost of C$0.65/gram, Organigram has a lower cost than any of its competitors. With these low costs, the company is better able to provide more compassionate pricing for the medical market. These low costs delivered stunning Q2 2019 results, including net revenue of $26.9 million, an adjusted gross margin of $16 million (60%), and an adjusted EBITDA of $13.3 million and margin of 49%.

4

STRATEGIC PARTNERSHIPS AND UNIQUE POSITIONING TOWARDS POT 2.0

Through strategic modular expansions, Organigram Holdings Inc. (NASDAQ:OGI) (TSX.V:OGI) is positioned for smooth licensing amendments to accommodate for growth. Instead of new buildings, existing facilities can be expanded with mere amendments to their current license. This streamlined process could give Organigram a significant first-mover advantage when edibles and derivative-based products become legal in Canada. The company also already has partnerships in place with Hyasynth, The Green Solution, Valens GroWorks, and Canada’s Smartest Kitchen to eventually produce beverages, chocolate edibles and extract material for high concentrates for vapes and edibles.

5

WEALTH OF EXPERIENCE FROM VARIOUS RELEVANT SECTORS

Organigram Holdings Inc. (NASDAQ:OGI) (TSX.V:OGI) is led by CEO Greg Engel, who prior to helming the company was the CEO of the first Canadian licensed producer to export product to the United States. Joining him are Senior Vice Presidents, Jeff Purcell, Ray Gracewood, and Tim Emberg, bringing multiple decades of experience in operations, and sales and marketing, with companies such as Ganong Bros. McCain Foods, Moosehead Breweries, and Frito-Lay.

Highest-Tier Financials With High-Quality Product, for Lowest Cost Per-Gram

Organigram Holdings Inc. Is Set For Expansion in 2019

Get Their Latest Press Releases Delivered To Your Inbox

Bonus: Sign Up Now and Get Your Free 2019 Pot Investor Guide

Disclaimer: This release/advertorial is a commercial advertisement and is for general information purposes only. This is a Native Advertisement, meaning it is an informational paid marketing piece. MarijuanaStox.com makes no recommendation that the securities of the companies profiled or discussed on this website should be purchased, sold or held by viewers that learn of the profiled companies through our website. Please review all investment decisions with a licensed investment advisor. This Advertorial was paid for by Organigram Holdings Inc. in an effort to enhance public awareness of Lifestyle Delivery Systems Inc. and its securities. Winning Media has or expects to receive one hundred twenty thousand USD dollars by Organigram Holdings Inc. as a total production budget for this advertising effort. Neither MarijuanaStox.com or Winning Media currently holds the securities of Organigram Holdings Inc. and does not currently intend to purchase such securities. This Advertorial contains forward-looking statements that involve risks and uncertainties. This Advertorial contains or incorporates by reference forward-looking statements, including certain information with respect to plans and strategies of the featured Company. As such, any statements contained herein or incorporated herein by reference that are not statements of historical fact may be deemed to be forward-looking statements. Without limiting the foregoing, the words “believe(s)” “anticipate(s)”, “plan(s)” “expect(s)” “project(s)” “will” “make” “told” and similar expressions are intended to identify forward-looking statements. There are a number of important factors that could cau se actual events or actual results of the Company to differ materially from these indicated by such forward-looking statements. Certain statements contained herein constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and 21E of the Exchange Act of 1934. Such statements include, without limitation, statements regarding business, financing, business trends, future operating revenues and expenses. There can be no assurance that such expectations will prove to be correct. Investors are cautioned that any forward-looking statements made by the Company, or contained in this advertorial are not guarantees of future performance, and that the Issuer’s actual results may differ materially from those set forth in the forward-looking statements. Difference in results can be caused by various factors including, but not limited to, the Company’s ability to be able to successfully complete planned funding agreements, to successfully market its products in competitive industries or to effectively implement its business plan or strategies. To reiterate, information presented in this advertorial contains “forward-looking statements”. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions, or future events or performance are not statements of historical fact and may be “forward-looking statements.” Forward-looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward-looking statements in this advertorial may be identified through the use of words such as “expects,” “will,” “anticipates,” “estimates,” “believes,” “may,” or by statements indicating certain actions “may,” “could,” or “might” occur. More information on the Company may be found at www.sec.gov readers can review all public filings by the Company at the SEC’s EDGAR page. MarijuanaStox.com is not a certified financial analyst or licensed in the securities industry in any manner. The information in this Advertorial is subjective opinion and may not be complete, accurate or current and was paid for, so this could create a conflict of interest.

Author: khemraj

https://t.me/pump_upp View all posts by khemraj